This is the third part to a three-parts series on the financial planning I’ve done / will be doing for my 9 months old daughter. Part 1 details how I am saving for her, part 2 describes my attempt at making these monies work, and lastly, part 3 documents the type of insurance coverage she has.

Saving and investing are important first steps to a more secured financial future. While we can do our best at preparing ourselves for whatever life has to throw at us, sometimes we just can't be prepared enough. This is why people get themselves insured. This is the only one thing that people pay money for, but do not wish to receive anything in return. (Note: I am referring to pure insurance policy that does not have any saving/investment component tagged to it.)

When life happens, and huge sum of money is required, there could only be three outcomes: Your savings are depleted, your loved ones' savings are depleted, or you drown yourselves in debt. Neither of these are pleasant outcome. If you have been thrifty, the last thing you would want to see the wealth that you have so painstakingly accumulated over the years get wiped out overnight. That is why I insist that I get myself, and everyone around me, insured against such life "happenings".

The most important policy that everyone should have is the Private Integrated Shield plan. The newly introduced Medishield Life covers all pre-exisiting conditions, which is awesome, but it still requires the insured to fork out the first $3000 (deductible) and co-pay 20% of the remaining amount (co-insurance). Further, if you are only covered under Medishield Life, your options are limited to B2 or C class wards, which is not-so-awesome. B2 and C class wards are also usually running at full capacity, which means you can expect yourself to stay along the corridor for the first part of your stay. For my daughter, I don't wish to limit her to such narrow options, which is why I got her covered up till private hospital under the Great Eastern's Supreme Health P-Plus plan.

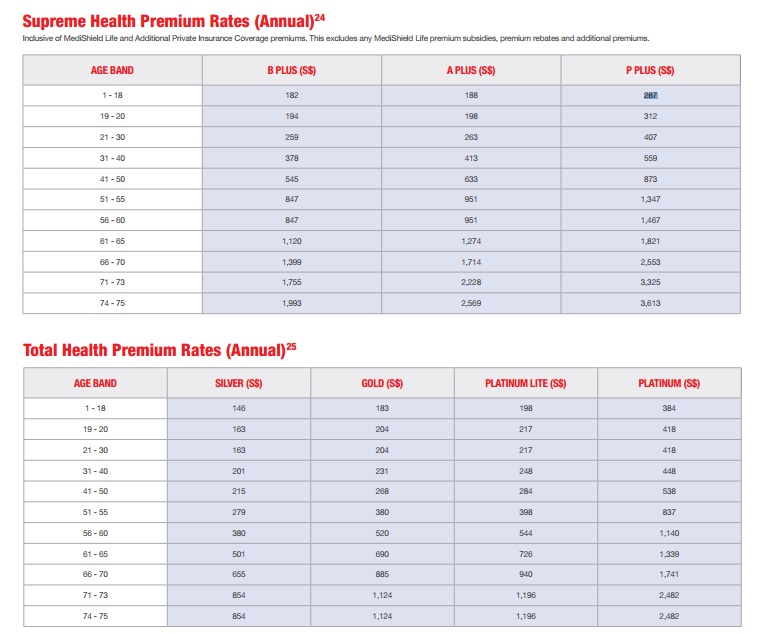

Though Supreme Health P-Plus covers my daughter should she be warded into a private hospital, it still has a deductible and co-insurance portion. To get my daughter fully covered, such that hospital bills are fully paid for by the insurer, the plan has to be supplemented by Total Health. The table below shows the premium rates for the various plans (correct as at 31 May 2016).

For my 9-month-old daughter, I have to fork out an additional $287 for her Supreme Health P-Plus Plan, and $384 for Platinum Total Health, on top of the premium she has to pay for the compulsory Medishield Life Plan. Part of these extra monies used to purchase her Additional Private Insurance Coverage can be paid for by her Medisave (which already has $4000 thanks to the Medisave Grant for Newborns), up till the Additional Withdrawal Limit (AWL) of $300 for her. More info here.

One of the added advantage of getting my daughter covered early is that as long as I continue to maintain the policy, she will be covered for all medical conditions. I would urge all parents to cover their children while they are still young and healthy. I am trying to get my parents covered, but because they already had some pre-existing conditions, any new coverage I buy now will exclude these existing conditions.