Is there an investment that gives you an instant

7.53% capital gain + a minimum yield on capital of at least 5.38% for the next 15 years? Sounds too good to be true? Read on to find out more!

I haven't given much thought to this excellent long term "investment" previously, but ASSI's blog post on "

How Younger Members can Get 6% per year from the CPF" inspired me to dig deeper and think harder. Yes, like what most of you seasoned personal-finance gurus would have figured out already, this investment is our CPF.

Before I came across the article, I only thought about contributing to my own CPF to get the 4% that our Special Account (SA) is yielding. But because I am 4 decades away from retirement, have a huge mortgage to service, a 10-month-old daughter to feed, and 2 aging parents who aren't quite prepared for their own retirement, I put off the idea.

But what if there is a new variety of seeds that will start to bear fruits in 15 years time? What if there is a 7% early bird discount now? Will I buy those seeds to plant them today? I am very tempted to.

Let me first explain how I got the numbers.

If I make a cash top-up to my loved ones' SA, I get to enjoy tax relief of up to $7000 per calendar year. In my latest year of assessment, after all the reliefs I qualify for, my chargeable income is between $40k to $80k. This means that if I were to contribute $7000 to my mum's SA, I will pay $490 lesser in tax (source:

IRAS). Essentially, this is like getting $490 for free from the government if I put in $6510, or a 5.38% gain in capital immediately (490/6510 x 100%). Got freebies who don't want???

*do note that any contribution above the Full Retirement Sum is not eligible for tax reliefs. My mum has (only) $12k (after checking, I realised she only has 2k, but nevermind, we can assume she has 12k for the subsequent illustrations in this post.) in her CPF, so I don't have to worry about that.

|

| Tax relief for the giver? It's like free money from the government! |

What about the 5.38% yield on capital that I purported above then? If you look at the footnote# under the table in the print screen above, the first combined balances of up to $60k attracts an additional 1% interest. This means that for my mum who just turned 50 this year, balances in her SA will earn 4+1 = 5%! But remember my capital outlay was only $6510? That gives me a yield on capital of 5.38% (350/6510 x 100%). Okay, I am really just playing with numbers here, but it really does sound like a good deal, doesn't it? Moreover, the interest rates will be bumped up to 6% for the first $30k when she turns 55.

So what's the game plan?

Given that I only qualify for 7% discount every year on the first $7000, with the likelihood of the discount getting bigger in the years ahead (pay rise, yay!), I am inclined to spread out my contribution.

Let's run some numbers.

|

| 8th Wonder of the World, indeed. |

Let's assume that my mum has $12k to begin with, and I start my yearly contribution of $7k just before she turns 51. This will last for 5 years. Thereafter, I will not contribute anymore.

Total capital outlay (after tax relief): $12,000 + ($6510 x 5) = $44,550

Balance at beginning of 65 (after compounding for 14 times) = $89,495.29

Not bad. Almost hitting the Basic Retirement Sum of $93,215 for her cohort.

How much can she expect to get every month?

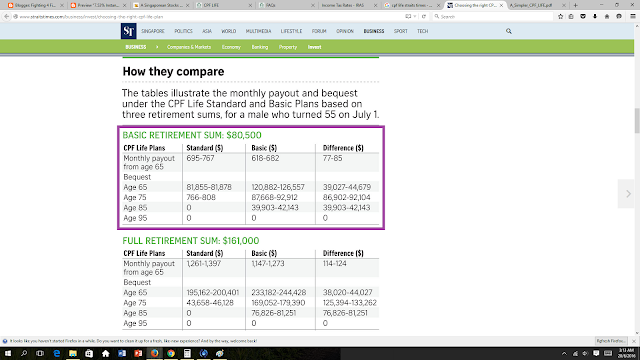

Referencing the Straits Times article published on 23 Aug, 2015, the amount one can expect to receive per month on the Basic Life plan is about $650.

(I will talk about why I prefer Basic Plan over Standard Plan in another post) This is based on $80,500 being set aside at age 55. I have no idea how the smarties in CPF or MOF came up with this numbers, and I concede that I am not half as smart as them. So how? How can a layman like me estimate the amount that my mum can expect to receive?

Let's try two methods:

First Method: Proportionality.

If $80,500 set aside at 55 results in about $650 a month from 65 onwards, $53,265 will result in...

(53,265/80,500) x 650 = $430

Second Method: Use the tools provided by CPF here, but tweak the inputs.

The tool only works for those who are between their payout eligibility age and 80 years old. For my mum's case, the tool doesn't work, but I can cheat the system a little to get an estimation.

Since we've already computed the amount she will have in her RA when she hit 65, I will simply assume that she has already hit 65 this year (means the year of birth is in 1951). The amount in her RA, I will input as $89,495 as computed.

Next, the tool will ask you for your annual assessable income and annual property value. This is to determine if you qualify for CPF Life Bonus. My mum does not, so I chose the highest range for both so

no bonus will be included in the calculation.

|

| Nope, my mum doesn't qualify for CPF Life Bonus. |

The result? She will receive about $444 a month. Not too far off from my first method, so I think it's rather safe to assume that she will receive slightly more than $400 monthly from 65 onwards.

Is this a good amount? I think it's not too shabby. It's not enough for sure, but it can certainly help to ease the financial burden a little.

What do you think? Are any of your parents without much money in their CPF? Maybe this might work out for you too.